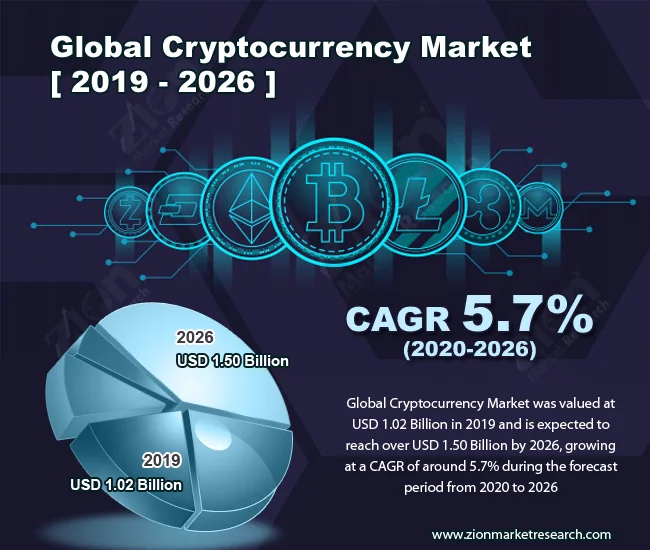

The Crypto Fog Thickens: 2026 Outlook

The cryptocurrency market in 2025 was… a lot. Regulatory clarity wrestled with market momentum, stablecoins elbowed their way into the spotlight, and institutions tentatively dipped their toes in the water. But was it progress, or just rearranging deck chairs on the Titanic? Let's cut through the noise.

Stablecoins Under Scrutiny: A Global Regulatory Race

One thing's clear: stablecoins aren't going away. TRM Labs noted that over 70% of jurisdictions were actively working on stablecoin regulation in 2025. The US GENIUS Act, the EU's MiCA rollout, and movements in Hong Kong, Japan, Singapore, and the UAE all point to a global scramble to define the rules of the game. This isn't about "embracing the future," it's about controlling it. Are regulators genuinely interested in innovation, or just in ensuring that these digital assets remain firmly within their grasp? I suspect the latter.

Institutional Adoption: Announcements vs. Action

The Global Crypto Policy Review Outlook 2025/26 Report suggests that regulatory clarity fueled institutional adoption. About 80% of the jurisdictions reviewed saw financial institutions announce new digital asset initiatives. But let's be real: "announcing initiatives" is a far cry from actually deploying significant capital. It's the difference between a press release and a balance sheet. Which jurisdictions will see those initiatives turn into real investments, and which will just be virtue signaling? The report highlights the US, EU, and parts of Asia as catalysts. But I've seen enough "catalysts" fizzle out to know that this is far from a sure thing.

Regulation's Uneven Impact: A Global Patchwork

Illicit Finance: Pushing the Problem Underground

The report also highlights the undeniable impact of regulation on illicit finance. VASPs (Virtual Asset Service Providers) – the most regulated segment of the crypto ecosystem – have significantly lower rates of illicit activity than the overall ecosystem. This isn't exactly groundbreaking. Of course regulated entities have lower rates of illicit activity. That's the point of regulation. The real question is: how much illicit activity is simply pushed to unregulated corners? The North Korea's Bybit hack, resulting in a $1.5 billion loss, underscores the problem. The attackers laundered proceeds through unlicensed OTC brokers, cross-chain bridges, and decentralized exchanges – infrastructure that largely sits outside existing regulatory perimeters.

Borderless Crypto, Fragmented Regulation: A Clash of Worlds

This highlights a fundamental problem: crypto's borderless nature clashes with fragmented regulatory frameworks. The FATF (Financial Action Task Force) warned that as long as gaps in standards implementation persist, "VASPs in jurisdictions with weak or non-existent frameworks" remain vulnerable to exploitation. The Financial Stability Board (FSB) echoed this, cautioning that "gaps and inconsistencies" in implementing standards could pose risks to financial stability and market resilience.

Quantifying Regulatory Arbitrage: The Missing Metric

I think a key element is lacking: a concrete method to quantify the "regulatory arbitrage" occurring. We can say there are "gaps," but are those gaps costing billions, or are we talking about rounding errors? Until we can put a number on the problem, policymakers are flying blind.

Argentina's Cautionary Tale: Regulation Isn't a Silver Bullet

Argentina's experience in 2025 offers a cautionary tale. While the government tightened regulatory oversight and introduced a framework for tokenized assets, President Milei's brief promotion of a meme coin, $LIBRA, (which then collapsed) sparked a judicial investigation. No charges have been filed, but the episode highlighted the risks of misinformation, market manipulation, and retail investor exposure in a lightly regulated environment. It's a reminder that regulation alone isn't a silver bullet; it needs to be accompanied by robust enforcement and investor education.

MiCA's Implementation: A Race to the Bottom?

Even in the EU, where MiCA (Markets in Crypto-Assets) is supposed to provide a harmonized regulatory framework, national differences in implementation are emerging. The French, Austrian, and Italian regulators have jointly called for a stronger European framework, citing "major differences in how crypto markets are being supervised by national authorities." Without stronger EU-level oversight, they warn, national authorities may be forced to resort to precautionary measures to prevent risks for national investors. This raises a critical question: will MiCA truly create a level playing field, or will it simply lead to a race to the bottom, with firms flocking to the jurisdictions with the weakest enforcement?

Conclusion: A Murky Crystal Ball

Looking ahead, the crypto market in 2026 faces a complex and uncertain future. Regulatory clarity is increasing, but its impact remains uneven and its effectiveness in curbing illicit activity is questionable. Institutional adoption is growing, but it's still early days. Stablecoins are gaining traction, but their long-term role in the financial system is far from clear.

The TRM Labs report paints a picture of a market at a crossroads. The challenge for regulators is to strike a balance between fostering innovation and mitigating risks. The challenge for investors is to navigate this complex landscape and identify the opportunities that are truly sustainable. The landscape is shifting, but the core questions remain: can crypto deliver on its promise of decentralization and financial inclusion, or will it simply become another tool for the powerful to consolidate their control?

Regulatory Theater: A Costly Diversion?

All this talk of "regulatory clarity" and "institutional adoption" feels a bit like regulatory theater to me. The real question isn't whether regulators are "doing something," but whether what they're doing is actually effective. Are we truly reducing risk, or just creating a costly and complex compliance burden that stifles innovation and drives activity underground? The numbers, as always, will tell the real story. And right now, those numbers are still too murky to draw any